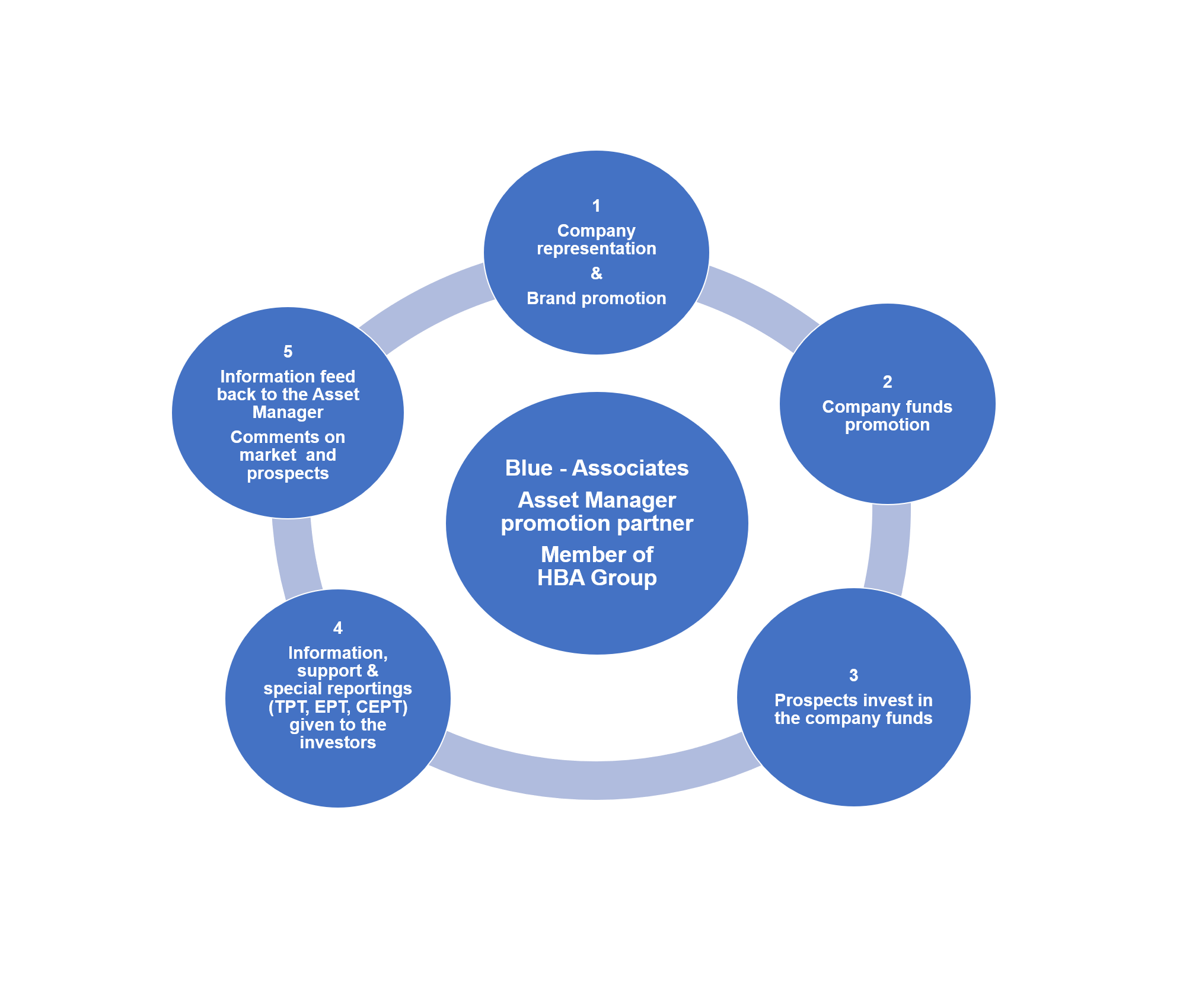

At Blue Associates, we offer our Asset Management Partners two lines of services:

- Asset Manager representation and promotion

We promote funds and mandates to professional investors, on behalf of our Asset Management Partners. We have been involved in this activity for over 25 years and have developed good long-term ties, based on trust and earnest relations.

We like to ascertain the activity of our Asset Management Partners, so we can show investors what is really happening in the management of their funds. Professional investors prefer to understand what the fund managers do, rather than read or listen to just another list of general market comments.

We explain potential increases or decreases in value, and the risks associated, in a transparent manner. We organise meetings and follow up on investment possibilities to create new valuable ties over the long term.

We report on our activities so that our Asset Management Partners know how we use our time.

- Client Services

We maintain and support relations between asset managers and investors over time, and work to add value to the ongoing relation.

To support the long term sales effort of our partners and firm up their long term brand, we operate in a spot between marketing, reporting, specific calculations, and some value-added services.

Examples include preparing, translating and wrapping-up of an RFP for a large institution, organising an ad-hoc reporting meeting with various parties, setting up a new monthly reporting pattern, preparing TPT (Solvency 2 transparency) reportings, wrapping-up EPT reportings, conducting PRIIPs scenario calculations and preparing KID deliverables, calculating and delivering monthly fund contributions, working on creating risk alerts for a fund manager.

We draw from our own forces and can rely on recognised actuarial firms, consultants, risk and compliance managers, who are Professional Investor partners.

We can manage this galaxy of services for our Asset Management Partners.